An In-Depth Review: Is Hosted Ethereum Mining the Future of Crypto Investment?

The evolution of cryptocurrency mining over the past decade has been nothing short of revolutionary. While Bitcoin (BTC) paved the way, Ethereum (ETH) has carved out its own niche, captivating investors and tech enthusiasts worldwide. With the rising complexity of mining and the increasing cost of acquiring and maintaining high-end mining rigs, hosted Ethereum mining emerges as a promising solution. This model, where mining hardware is housed and operated in a professional data center or “mining farm,” offers a blend of convenience, scalability, and efficiency. But does it represent the future of crypto investment? Let’s delve into the nuances.

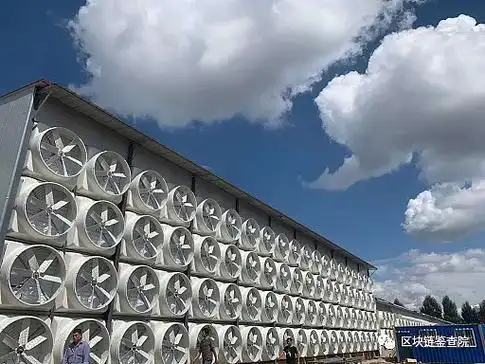

Ethereum’s transition from Proof of Work (PoW) to Proof of Stake (PoS) via Ethereum 2.0 has generated waves of discussions in the crypto community. Yet, as of today, PoW mining rigs still dominate those eager to capitalize on the mining rewards offered by the network. Unlike the solitary, at-home setups of early BTC miners, Ethereum miners are increasingly seeking hosted mining solutions. These hosted platforms provide greater uptime, better cooling conditions, and often access to cheaper electricity—key factors that significantly influence the profitability of mining ETH through rigs designed explicitly to handle its unique hashing algorithms.

The critical advantage of hosted Ethereum mining lies in its ability to alleviate the typical miner’s headaches: technical maintenance, hardware failures, and energy management. Data centers specializing in mining invest heavily in redundant power systems, cooling, and dedicated network infrastructure. For investors unfamiliar with the nuances of mining rig optimization—balancing hash rates, power consumption, and GPU temperatures—outsourcing to a hosted service can turbocharge returns. Furthermore, these farms achieve economies of scale, buying hardware en masse and operating them at full throttle, all while passing savings to clients.

Of course, Ethereum’s mining competitiveness has extended beyond mere individual miners. Massive Bitcoin mining farms have long demonstrated that large-scale operations wield a significant edge in the crypto race. Hosted ETH mining providers essentially replicate this model on a smaller scale, catering to individuals or institutional investors who want to avoid the logistical nightmare of owning and running machines themselves. This democratization of mining access capitalizes on the growing interest in crypto investment by lowering barriers and mitigating risks.

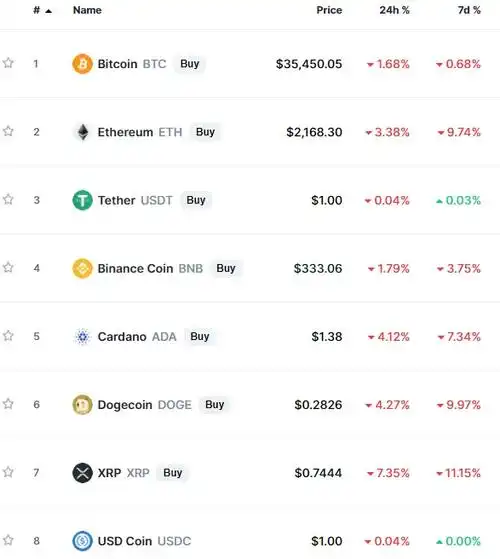

Yet, Ethereum isn’t the only player attracting miners. Dogecoin (DOG), celebrated for its passionate community and meme-driven popularity, is also making inroads. Although it relies on a different consensus mechanism and mining algorithm, miners frequently diversify their rigs’ output by switching between cryptocurrencies aligned with their hardware capabilities and market dynamics. This versatility is crucial because crypto markets are inherently volatile; prices of ETH, DOG, BTC, and others can swing dramatically within days or even hours. Hosted mining solutions often provide dashboard analytics with live profitability tracking, enabling miners to pivot their focus dynamically.

And then there is the intricate dance involving cryptocurrency exchanges. Exchanges like Binance, Coinbase, and Kraken have expanded their services quaintly beyond trading, now offering staking and mining-linked investment products. Hosted mining outfits sometimes partner with these exchanges to facilitate smoother liquidity and create seamless onramp opportunities for investors. Customers might buy ETH or BTC mined through hosted rigs and immediately trade or stake them on a connected platform—this synergy enhances the appeal of hosted mining as part of a broader investment ecosystem.

Technical innovation is another driver behind hosted mining’s rising popularity. Newer mining rigs boast improved hash rates and power efficiency; combined with AI-powered performance monitoring, these machines can squeeze every fraction of a percentage point in energy and computational advantage. Moreover, hosted mining farms adapt more swiftly to regulatory changes and environmental concerns than decentralized, at-home miners. In jurisdictions where energy consumption faces cracks of limitation, hosted services can optimize operations by using renewable energy sources or tapping cheaper energy markets.

But mining remains an arms race. The relentless pace at which miners upgrade rigs, embrace ASIC technologies for Bitcoin, or optimize GPUs for Ethereum incurs substantial capital outlay. Hosted mining models mitigate this cost by offering subscription-based or pay-as-you-go mining contracts. Investors evade the steep upfront capital in mining rig acquisition, instead leveraging expertise housed within data centers. In doing so, they shift focus from hardware management to investment strategy—integrating mining income into diversified crypto portfolios.

However, prospective investors should mind the caveats. Hosted mining returns depend heavily on electricity prices, network difficulty, hardware depreciation, and, crucially, the price of the underlying cryptocurrency. Ethereum’s upcoming full adoption of Proof of Stake may render traditional mining obsolete, potentially undermining equipment value and hosted mining contracts. Similarly, sudden market crashes or exchange freezes can stunt exit alternatives for miners relying on liquid crypto assets. A savvy investor keeps abreast of these dynamics and evaluates hosted mining not as a guaranteed income stream but as an integral element in a multi-pronged crypto investment approach.

In conclusion, hosted Ethereum mining exemplifies the confluence of technology, finance, and innovation that characterizes the broader crypto revolution. It reduces complexity, democratizes access, and enhances scalability for those keen on participation without operational friction. While Ethereum’s core protocol evolution casts uncertainty, hosted mining remains a relevant and potent pathway—especially when integrated with savvy portfolio management and adaptive market strategies. For investors seeking to merge the thrill of mining with the safety net of professional hosting, the future looks promisingly diverse and dynamic.

Hosted Ethereum mining simplifies crypto entry with low barriers and potential yields, but its future hinges on market volatility and regulations. An intriguing option for savvy investors, yet a risky bet in the ever-shifting blockchain landscape.