Comparing Mining Profitability: Hosted Mining vs. Self-Managed Solutions

In the constantly evolving landscape of cryptocurrencies, mining remains a cornerstone for both enthusiasts and professionals aiming to secure digital assets and earn rewards. As digital currencies like Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOG) gain traction, investors face a pivotal choice: should they venture into mining through hosted services or opt for self-managed mining rigs? Understanding the nuances between hosted mining and self-managed solutions is vital, as profitability hinges on factors beyond mere hash rates and market prices.

Hosted mining, also known as cloud mining or mining machine hosting, involves leasing mining hardware located off-site, typically in optimized mining farms. Users purchase or rent mining power without worrying about hardware maintenance, electricity, or cooling issues that commonly afflict self-managed miners. This approach appeals especially to those unwilling to handle the technical and logistical challenges of managing mining rigs themselves. By delegating these operational concerns, miners can focus solely on strategy and monitoring profitability.

On the flip side, self-managed mining offers enthusiasts full control over their mining operation. From selecting mining rigs to fine-tuning firmware, miners enjoy hands-on involvement in every step. This level of control can yield higher returns, particularly when miners capitalize on cheaper electricity rates, negotiate hardware discounts, or deploy heat recycling methods to reduce costs. However, such freedom demands vigilance; miners must troubleshoot downtime, optimize performance, and bear all hardware replacement expenses.

Bitcoin mining stands as a prestigious exemplar where the debate between hosted versus self-managed mining is most vibrant. Bitcoin’s intense network difficulty requires powerful ASIC miners. Hosted mining services specializing in BTC allow users to access state-of-the-art ASICs housed in data centers strategically located near low-cost energy sources. This placement dramatically lowers operational expenses and often translates to steady, predictable returns. Conversely, individuals owning personal Bitcoin miners grapple with variable electricity costs, heat dissipation, and physical security, sometimes eroding overall profitability.

ETH mining, traditionally utilizing GPUs, presents more flexibility. Self-managed miners can customize rigs with varying graphics cards, tweaking performance for optimal energy efficiency. Yet, with Ethereum embracing a shift toward proof-of-stake (PoS) consensus, GPU miners are reevaluating their commitment. Hosted mining providers specializing in ETH have begun transitioning equipment for mining other altcoins or integrating hybrid services, offering clients continuity despite Ethereum’s network evolution.

Dogecoin, an altcoin known for its meme-inspired origin, leverages merged mining with Litecoin. This mechanism allows miners to simultaneously mine both DOG and LTC with compatible rigs, amplifying profitability. For self-managed miners or mining farms, merged mining introduces a unique layer of strategy when assembling mining rigs: choosing hardware with the versatility to maximize dual mining. Hosted mining services that offer merged mining solutions enable users to harness this benefit without direct hardware concerns.

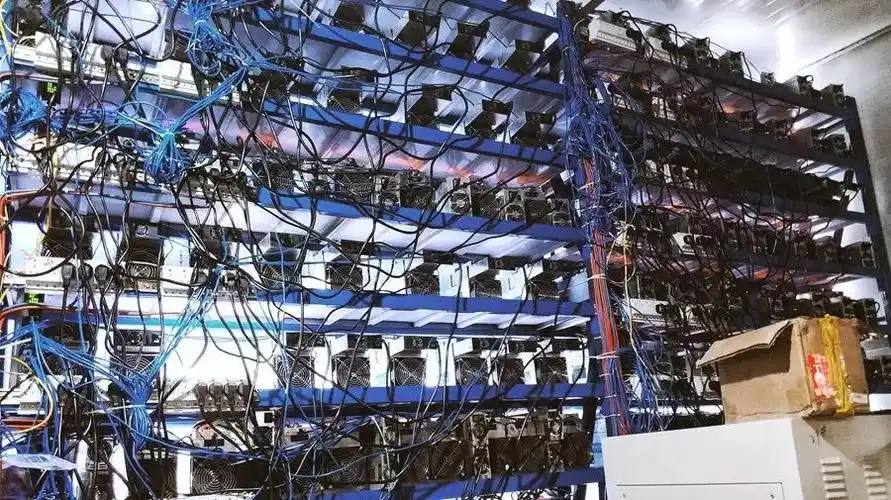

Mining farms, often sprawling complexes filled with rows upon rows of mining rigs, epitomize industrial-grade self-managed hosting. These facilities, operated by professional miners or companies, highlight economy-of-scale effects. By amassing thousands of mining machines and harnessing specialized cooling systems, such farms optimize electricity usage and overall mining efficiency. Investing directly in such farms or acquiring hosted mining contracts provides a way to ride the crypto boom without the day-to-day rig management burden.

Miners face another crucial consideration: market volatility. Cryptocurrency prices, including BTC, ETH, and DOG, fluctuate wildly, impacting mining profitability. Hosted mining contracts often lock users into fixed fees or profit-sharing models, insulating them from short-term swings but potentially limiting upside gains. Self-managed miners, conversely, can dynamically adjust their mining strategies or momentarily pause operations based on price trends, thus exercising greater autonomy but assuming increased risk exposure.

Exchanges play an integral role in the mining ecosystem, serving as gateways for liquidating mined coins or trading between various cryptocurrencies. In hosted mining, proceeds from mined currency are usually credited directly to users’ exchange wallets, enabling quick reinvestment or diversification. Self-managed miners might prefer direct wallet transfers, affording them discretion over coin custody but demanding more security diligence.

In summary, the decision between hosted mining and self-managed solutions is anything but straightforward. Hosted mining offers convenience, mitigated operational risks, and potential access to larger mining farms, making it ideal for newcomers or those lacking technical expertise. Contrastingly, self-managed miners enjoy granular control, customization, and possibly higher profit margins, but shoulder the responsibilities of maintenance, cost management, and market volatility. As the cryptocurrency ecosystem matures, hybrid models blending hosted services with user-driven innovation may well emerge, further enriching the mining industry’s dynamic landscape.

This article adeptly contrasts hosted mining’s ease and cost efficiencies against self-managed solutions’ control and potential long-term gains, revealing surprising profitability twists that could reshape your crypto strategy.